Welcome To Our Company

Best Tech & Marketing Partner for a Global Community

The goal of our work is simple: build smart technology and bold marketing that move the needle. We design, ship, and scale solutions that help you hit targets faster—without the fuss.

Development Services

From idea to launch, we craft fast, secure, and scalable products—websites, web apps, mobile apps, and custom integrations. Clean architecture, clear sprints, measurable outcomes.

Marketing Services

Brand strategy, content, paid media, and lifecycle automation that actually convert. We blend creativity with data to turn attention into revenue—again and again.

Consulting Services

Not sure where to start? We align stakeholders, sharpen the brief, and map the shortest path to ROI. Strategy first, execution on tap.

About Proximity

Connecting People and Building Technology

For over a decade, we’ve helped startups, scaleups, and global teams launch products and campaigns that matter. With cross-functional squads—dev, design, data, and growth—we work as an extension of your team. No black boxes. No runarounds. Just momentum.

All In One IT Solution Company

Amazing Expert Teams

Quality Solution For Business

24/7 Quick Supports

Get To Know The Incredible Individuals Behind Our Company

VtuberGame – Ultimate Hub for VTuber Gaming Fans

Welcome to VtuberGame, the ultimate gaming hub designed specifically for fans of VTubers and the vibrant world of VTuber gaming. Here, enthusiasts can connect with one another, share their experiences, and access exclusive content about their beloved VTubers. With a plethora of exciting features and a welcoming community, VtuberGame is the go-to platform for anyone looking to fully immerse themselves in the electrifying realm of VTuber gaming.

Key Takeaways

- VtuberGame serves as a comprehensive platform for VTuber fans.

- The hub facilitates connection and engagement among the VTuber community.

- Enjoy exclusive content related to your favorite VTubers.

- VtuberGame features an array of interactive opportunities.

- This gaming hub highlights the unique aspects of VTuber culture.

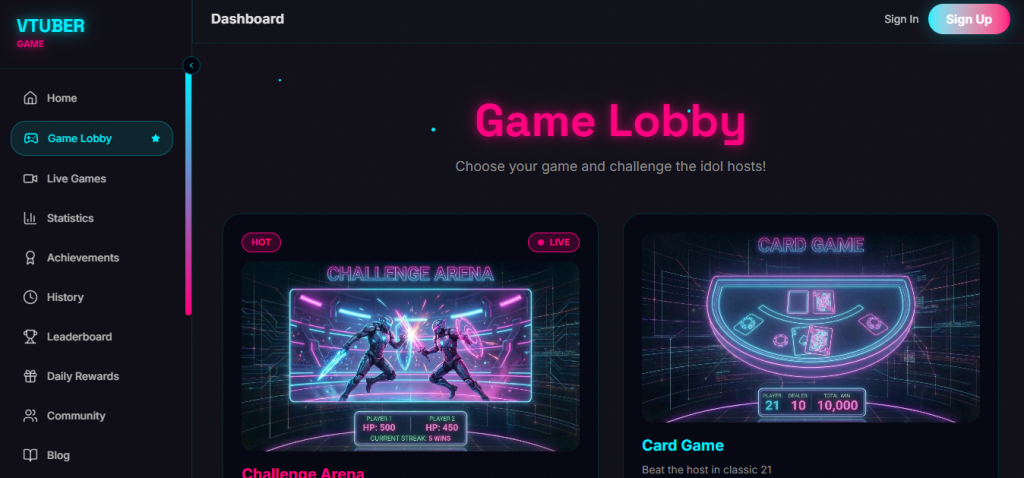

Introduction to VtuberGame

With the rise of VTubers, the introduction to VtuberGame comes at an opportune moment for both creators and gaming fans. This innovative VTuber platform has emerged as a vibrant hub that caters to the preferences and interests of this unique community. VtuberGame is designed to provide engaging gaming content while fostering collaboration and creativity among its members.

The platform stands out due to its user-friendly interface, allowing newcomers to navigate effortlessly and discover exciting content. Gaming fans can easily access a variety of VTuber-led games, livestreams, and community interactions, all in one place. The dynamic features of VtuberGame make it a go-to destination for anyone looking to immerse themselves in the world of VTubing.

VtuberGame not only highlights individual creators but also encourages gamers to connect with others who share their passion. This community-driven approach enhances the overall experience, enabling members to participate in events, share content, and support one another as they navigate the exciting world of VTubers.

Why VtuberGame is the Go-To Hub for Fans

VtuberGame has quickly become a preferred destination for fans seeking an active and vibrant online community. The platform emphasizes community building, allowing users to immerse themselves in an engaging environment where they can share their love for VTubers and gaming.

The benefits of VtuberGame extend beyond mere gameplay. This platform integrates visual storytelling and gaming experiences, creating spaces where fans can interact with their favorite VTubers. Such interactions foster a sense of belonging, turning casual viewers into dedicated community members.

With features designed to enhance fan engagement, VtuberGame presents various events and activities tailored for its audience. Users can participate in live streams, discussions, and collaborative projects, which strengthen connections and broaden their social circles within the community.

Furthermore, the diverse range of content available encourages fans to explore new games and stories, promoting creativity and collaboration. VtuberGame stands as a pioneering platform for those who wish to dive deep into the exhilarating world of VTubers while enjoying the benefits of VtuberGame through meaningful engagement with others. This combination ensures that fans feel valued and connected, making it a top choice for enthusiasts.

Features of VtuberGame

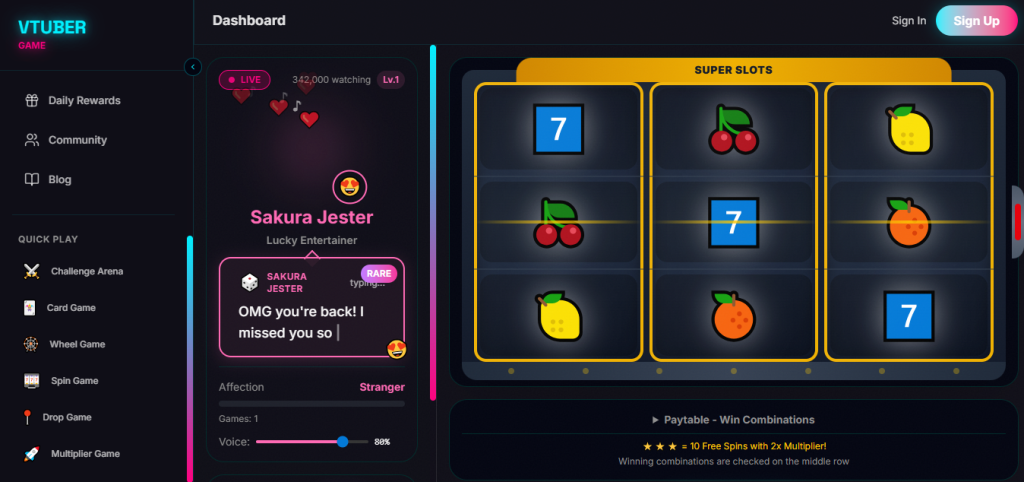

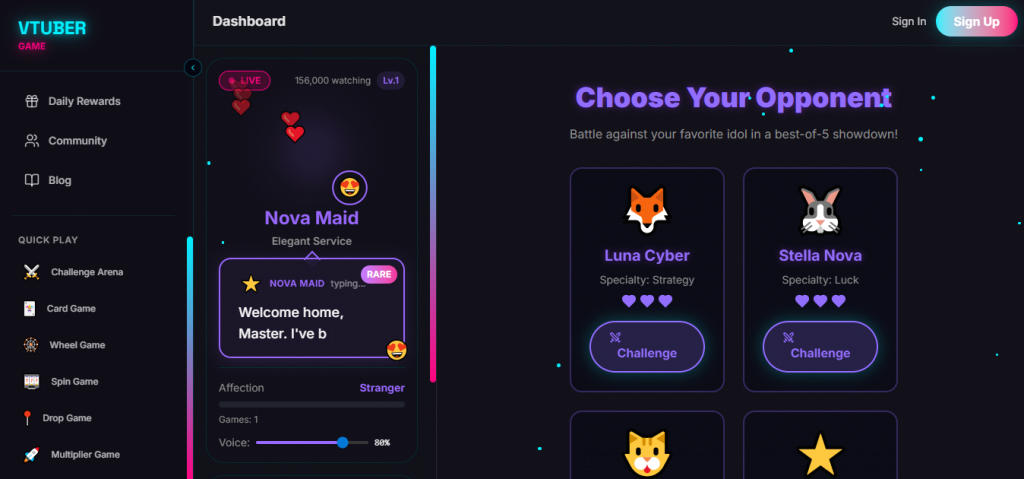

VtuberGame features an array of offerings designed to enrich the gaming experiences of its users. These include vibrant live streaming events that allow direct interaction with favorite VTubers, fostering community engagement and a sense of belonging. The platform enhances fan interaction through various avenues to connect and collaborate.

Live Streaming Events

The live streaming aspect of VtuberGame captivates audiences with immersive events ranging from gaming sessions to Q&A segments. Fans can interact in real-time, sharing their reactions and asking questions while participating in exciting VTuber events. This level of accessibility creates dynamic live streams that transform viewers into active contributors, increasing the overall engagement with the community.

Community Interaction and Engagement

Community interaction thrives on VtuberGame through engaging features such as community forums and chat rooms. Users can share their content, interact with fellow fans, and contribute to discussions about their favorite VTubers. These engagement features are crucial in building a strong community where shared passion for interactive gaming flourishes.

Exclusive Game Content

Members of VtuberGame gain access to exclusive content, including game updates, previews, and opportunities to participate in beta tests. Such exclusive content keeps fans excited, offering them a first glimpse into new releases and promotions directly from the VTubers they admire. This access not only fuels anticipation but also strengthens the bond between the creators and their audience.

The Growing Popularity of VTubers

VTubers have significantly contributed to the evolution of the gaming landscape, leading to profound gaming culture change. These virtual personalities combine engaging storytelling with interactive experiences, capturing the attention of a younger audience and driving the surge in VTuber trends. The popularity growth of these characters showcases their lasting influence on gaming culture and content consumption.

Impact on Gaming Culture

The rise of VTubers has transformed how gaming is perceived and enjoyed. Embracing anime aesthetics, they offer a unique blend of entertainment that goes beyond traditional gameplay. This phenomenon has reshaped gaming trends, creating an environment where audiences can engage actively rather than passively. Fans often rally around their favorite VTuber influencers, forming communities that celebrate shared interests and creative expressions.

VTuber Influencers and Their Reach

VTuber influencers wield considerable power within the gaming world. Their ability to connect with diverse fan bases stems from innovative outreach strategies that leverage social media and streaming platforms. By showcasing distinct personalities and interactive gameplay, these influencers transcend geographical boundaries, fostering a global fan community. As a result, the influence of VTubers extends beyond entertainment, creating a cultural exchange that enriches the entire gaming ecosystem.

How to Get Started with VtuberGame

Getting started with VtuberGame involves a straightforward process that helps users create their VtuberGame account easily. This journey begins with the sign-up process, where new members complete a few necessary steps to ensure a smooth user experience.

Creating an Account

The account creation process is designed to be user-friendly. To begin, users must provide basic information such as a username, email address, and a password. Following the user registration, individuals receive a confirmation email to verify their identity. Accepting the community guidelines is essential to promote a safe gaming environment.

Exploring Game Categories

After successfully creating an account, users can dive into the diverse game categories available on VtuberGame. The site’s intuitive navigation allows players to find various genres, including action, adventure, and RPG. With well-organized sections, discovering new content and engaging with favorites becomes a delightful experience.

| Game Category | Description | Popular Titles |

|---|---|---|

| Action | Fast-paced games that require skill and quick reflexes. | Game Title A, Game Title B |

| Adventure | Story-driven games that focus on exploration. | Game Title C, Game Title D |

| RPG | Role-playing games where players assume character roles. | Game Title E, Game Title F |

Engaging with various game categories enhances user experience and allows community members to connect over similar interests. VtuberGame is evolving as a favorite spot for VTuber gaming fans, making account creation and navigation essential components of the overall experience.

Benefits of Joining the VtuberGame Community

Joining the VtuberGame community offers numerous community benefits that enrich the gaming experience. Fans gain the opportunity to engage with others who share similar interests, fostering unique fan connections and diverse networking possibilities. This vibrant community forms the backbone of VtuberGame, making it an inviting space for new and seasoned enthusiasts alike.

Networking with Other Fans

Networking is crucial in any social setting. In the VtuberGame community, members have ample chances to connect, collaborate, and share their love for gaming. By participating in discussions, online forums, and collaborative projects, fans can cultivate valuable relationships with fellow gamers and content creators, enhancing their gaming journey with enjoyable exchanges and insights.

Access to Exclusive Events and Updates

Membership in VtuberGame comes with exclusive access to events tailored just for the community. These exclusive events, such as gaming tournaments, live Q&A sessions with VTubers, and special announcements regarding upcoming titles, keep members informed and engaged. Regular updates ensure fans are at the forefront of all the latest happenings, amplifying the overall experience of being part of this dynamic community.

VtuberGame: A Platform for Content Creators

VtuberGame serves as an invaluable resource for content creators eager to excel in the ever-evolving landscape of VTuber promotion. With a plethora of engaging community events and interactive features, creators can significantly boost their channel visibility. Utilizing effective marketing strategies is essential for enhancing their audience reach and supporting their creative endeavors.

How to Promote Your VTuber Channel

Promoting channels on VtuberGame involves tapping into various community resources. Active participation in forums and events increases engagement, which is crucial for effective content creation. Embracing creator tips such as sharing highlights from streams or collaborating with others amplifies visibility and connects creators with audiences that appreciate their style.

Collaboration Opportunities Within the Community

Collaboration is at the heart of VtuberGame’s community spirit, offering numerous opportunities for joint streams and innovative projects. Creators can develop community partnerships that make their content more dynamic and appealing. Working alongside fellow creators fosters an environment enriched with creativity and shared resources, positioning members to gain exposure while enhancing their individual and collective content.

VtuberGame Success Stories

VtuberGame has played a pivotal role in the rise of many popular VTubers, offering an ideal space for them to display their skills and interact with fans. These success stories reflect the platform’s impact on individual creators and the larger gaming community.

Highlighting Popular VTubers Who Thrived Through the Platform

Several successful VTubers have emerged through VtuberGame, harnessing its features to enhance their brand recognition. Creators share their personal success accounts, emphasizing how community feedback and engagement have significantly broadened their audience. The platform has provided tools enabling them to reach new heights, whether through live streaming or collaboration with fellow creators. Many of these VTubers attribute their growth to the supportive environment that VtuberGame fosters, allowing for meaningful connections with fans.

Community Testimonials

Community feedback is a valuable component of the VtuberGame experience. Users frequently highlight how the platform has enriched their gaming journeys. User testimonials showcase the positive outcomes of engagement within the community, revealing an enriching atmosphere that promotes collaboration and interaction. Many players find that community success translates directly into personal achievements, reinforcing the value of being part of such a dynamic platform.

Staying Updated with VtuberGame

For fans eager to keep up with the latest happenings, VtuberGame offers various avenues to stay informed. Regular updates and community announcements are shared through newsletters and social media platforms. By following these channels, users can receive timely news regarding platform updates and upcoming community events, ensuring they remain in the loop.

Following News and Updates

The news feed plays a critical role in connecting members with important updates. Subscribers can easily access a steady stream of information, including details about new features and events. Staying informed enhances user experience and participation in various activities.

Participating in Community Events

Community participation is essential for a vibrant atmosphere. Engaging in contests, discussions, and other events creates meaningful connections among users. These engagement opportunities not only foster camaraderie but also encourage meaningful interactions across the platform.

| Type of Event | Description | Participation Methods |

|---|---|---|

| Contests | Creative competitions for showcasing skills. | Through submissions or voting. |

| Live Discussions | Engaging dialogues on current topics. | Join online meetings or forums. |

| Official Announcements | Updates directly from VtuberGame representatives. | Follow via social media or subscribe to newsletters. |

Conclusion

In summary, VtuberGame serves as a dynamic and engaging hub specifically designed for fans of VTubers and gaming. Its unique features, including community interaction and exclusive game content, create an inviting atmosphere that fosters connection among users. The VtuberGame overview reflects how this platform stands out as a leader in the evolving VTuber gaming landscape.

As VTubers continue to gain prominence, the community benefits from access to tailored resources that cater to both fans and content creators. This thriving environment not only enhances user experiences but also encourages collaboration and networking opportunities. The platform future looks promising as more enthusiasts join, fueling a vibrant global community.

Ultimately, VtuberGame provides a vital space for both fans and creators to unite around their shared passion for VTubers and gaming. With its focus on engagement and support, it’s an exciting time for anyone involved in this ever-growing scene.

FAQ

What is VtuberGame?

VtuberGame is a comprehensive platform designed specifically for VTuber fans and gamers. It serves as a hub where community members can connect, share experiences, and discover exclusive content related to their favorite VTubers.

How do I create an account on VtuberGame?

To get started with VtuberGame, simply follow the user-friendly sign-up process by providing basic information and agreeing to our community guidelines. This ensures a safe and enjoyable environment for all members.

What features are available on VtuberGame?

VtuberGame offers an array of features, including live streaming events, community interaction via forums and chat rooms, and access to exclusive game content. Members can also participate in gaming tournaments and special announcements.

Why are VTubers gaining popularity?

VTubers are transforming gaming culture by merging anime aesthetics with interactive experiences, appealing to a younger audience. Their widespread influence is reshaping how gaming content is produced and consumed across various platforms.

How can I connect with other fans on VtuberGame?

Joining the VtuberGame community allows you to network with like-minded fans who share your passion for gaming and VTubers. This can lead to new friendships, collaborations, and participation in community activities.

Are there any opportunities for content creators on VtuberGame?

Absolutely! Content creators can promote their VTuber channels through interactive community events and collaboration with other creators. The supportive environment encourages joint streams and creative partnerships.

How can I stay updated with the latest news and events on VtuberGame?

VtuberGame provides regular updates and announcements via newsletters and social media. By following these channels, you will never miss out on important information, including new features and upcoming events.

Can I access exclusive content on VtuberGame?

Yes, members can enjoy exclusive game content such as previews, beta tests, and limited-time events. This unique access fuels excitement among fans, giving them the first look at new releases directly from their favorite VTubers.

What are some success stories from VtuberGame?

VtuberGame has helped numerous VTubers thrive by providing a platform to showcase their talents. Many successful creators share testimonials, highlighting how engaging with the community has expanded their reach and boosted their brand recognition.

Explore Top Investment Opportunities Today

In today’s ever-changing financial landscape, it’s crucial to stay informed about the best ways to grow your wealth. With numerous top investments available, diversifying your portfolio is key to achieving financial stability.

Whether you’re a seasoned investor or just starting out, understanding the available investment opportunities can help you make informed decisions and achieve your financial goals. By exploring the various options, you can create a robust financial strategy that aligns with your objectives.

Key Takeaways

- Staying informed about the financial landscape is crucial for growth.

- Diversifying your portfolio is key to achieving financial stability.

- Understanding top investments can help you make informed decisions.

- A robust financial strategy aligns with your objectives.

- Making informed decisions is vital for achieving financial goals.

The Current Financial Landscape

Understanding the financial landscape is crucial for investors in today’s market. The current financial environment is shaped by a multitude of factors, including economic indicators, geopolitical events, and technological advancements.

Economic Factors Influencing Markets

Economic factors such as interest rates, inflation, and employment rates significantly influence market trends. For instance, rising interest rates can impact borrowing costs, affecting consumer spending and business investments. Investors must stay informed about these factors to make strategic decisions.

Post-Pandemic Investment Environment

The post-pandemic era has brought about a new investment landscape, with some sectors experiencing rapid growth while others face challenges. The shift towards digitalization and renewable energy has created new opportunities for investors.

| Economic Factor | Impact on Investments |

|---|---|

| Interest Rates | Affects borrowing costs and consumer spending |

| Inflation | Influences purchasing power and investment returns |

| Employment Rates | Impacts consumer confidence and economic growth |

Top Investment Opportunities in 2023

The year 2023 brings forth a multitude of investment opportunities, ranging from emerging sectors to established markets. Investors are presented with a diverse array of options, each with its unique growth potential and risk profile.

Emerging Sectors with Growth Potential

Emerging sectors are at the forefront of innovation, offering significant growth opportunities. Two key areas that stand out are technology and innovation, and healthcare and biotech.

Technology and Innovation

Technology investments are driving the future, with advancements in AI, cybersecurity, and cloud computing leading the charge. Companies that are pioneering these technologies are expected to see substantial growth.

Healthcare and Biotech

The healthcare and biotech sector is another area of significant potential. With an aging population and the ongoing need for medical innovation, investments in this sector are likely to yield considerable returns.

Established Markets Worth Considering

While emerging sectors are exciting, established markets continue to offer stable and attractive investment opportunities. Consumer goods and energy transition are two such areas.

Consumer Goods

Investing in consumer goods can provide a stable source of returns, as these companies often have strong brand recognition and consistent demand.

Energy Transition

The shift towards renewable energy is gaining momentum, making energy transition a compelling investment opportunity. Companies involved in solar, wind, and other renewable energy sources are poised for growth.

By diversifying across both emerging sectors and established markets, investors can create a balanced portfolio that is well-positioned for success in 2023.

Stock Market Investments

The stock market presents a myriad of investment opportunities, catering to both conservative and aggressive investors alike. With various options available, investors can choose the strategies that best fit their financial goals and risk tolerance.

Blue-Chip Stocks for Stability

Blue-chip stocks are known for their reliability and stability, making them an attractive option for conservative investors. These stocks are typically from well-established companies with a history of consistent performance. Investing in blue-chip stocks can provide a steady foundation for your investment portfolio.

Growth Stocks for Capital Appreciation

Growth stocks offer the potential for significant capital appreciation, making them suitable for investors seeking higher returns. These stocks are typically from companies that are expected to experience higher-than-average growth rates. Investors should be aware that growth stocks can be more volatile.

Dividend Stocks for Income

Dividend stocks provide a regular income stream, making them appealing to investors looking for predictable returns. Within this category, there are specific types of dividend stocks that stand out.

Dividend Aristocrats

Dividend aristocrats are companies that have increased their dividend payouts for at least 25 consecutive years. These stocks are considered reliable for generating consistent income.

Dividend ETFs

Dividend ETFs allow investors to diversify their income streams by pooling funds into a variety of dividend-paying stocks. This can reduce risk and increase potential returns.

Real Estate Investment Strategies

Real estate investment remains a cornerstone of wealth creation, offering diverse strategies for investors. Whether you’re a seasoned investor or just starting out, understanding the various real estate investment options is crucial for making informed decisions.

Residential Property Investments

Residential properties are a popular choice among real estate investors. They offer the potential for rental income and capital appreciation.

Single-Family Homes

Single-family homes are often considered a stable investment, providing a steady stream of rental income. They are typically easier to manage than larger properties.

Multi-Family Properties

Multi-family properties, on the other hand, can offer higher returns due to multiple rental units. However, they require more management and maintenance.

Commercial Real Estate

Commercial real estate involves investing in properties used for business purposes, such as office buildings or retail spaces. This type of investment can provide stable long-term leases and potentially higher returns.

Real Estate Investment Trusts (REITs)

REITs allow individuals to invest in real estate without directly managing properties. They offer a diversified portfolio and can provide a steady income stream.

To illustrate the potential returns on different real estate investments, consider the following table:

| Investment Type | Potential Annual Return | Risk Level |

|---|---|---|

| Single-Family Homes | 4-6% | Low-Moderate |

| Multi-Family Properties | 6-8% | Moderate-High |

| Commercial Real Estate | 5-7% | Moderate |

| REITs | 4-8% | Low-High |

Bond and Fixed Income Options

Investors seeking stable returns often turn to bond and fixed income options. These investments provide a relatively low-risk way to generate income, making them an essential component of a diversified portfolio.

Treasury Bonds and Notes

Treasury bonds and notes are backed by the government, offering a low-risk investment. They come with various maturities, ranging from a few years to several decades, allowing investors to choose a term that fits their financial goals. Treasury bonds are particularly attractive during times of economic uncertainty due to their reliability.

Corporate Bonds

Corporate bonds are issued by companies to raise capital. They typically offer higher yields than treasury bonds to compensate for the increased risk. Investors should carefully evaluate the creditworthiness of the issuing company to assess the likelihood of default. High-yield corporate bonds can be particularly appealing for those willing to take on more risk.

Municipal Bonds for Tax Advantages

Municipal bonds are issued by local governments and other public entities to fund projects. They offer tax advantages, as the interest earned is often exempt from federal and state taxes. This makes them particularly attractive to investors in higher tax brackets. Municipal bonds can provide a tax-efficient way to generate income.

In conclusion, bond and fixed income options offer a range of choices for investors looking to balance risk and return. By understanding the characteristics of treasury bonds, corporate bonds, and municipal bonds, investors can make informed decisions that align with their financial objectives.

- Treasury bonds: Low-risk, government-backed investments.

- Corporate bonds: Higher yield, higher risk investments issued by companies.

- Municipal bonds: Tax-advantaged investments issued by local governments.

Alternative Investment Opportunities

Alternative investments provide a distinct avenue for diversification, reducing reliance on conventional assets. As investors seek to spread risk and potentially enhance returns, alternatives such as cryptocurrency, commodities, and collectibles are gaining attention.

Cryptocurrency and Blockchain

Cryptocurrency, led by Bitcoin, has emerged as a popular alternative investment. The underlying blockchain technology offers transparency and security, making it an attractive option for those looking to diversify. Investors should be aware of the volatility and regulatory risks associated with cryptocurrency.

Commodities and Precious Metals

Commodities, including precious metals like gold and silver, are traditional hedges against inflation and market downturns. Gold, in particular, is seen as a safe-haven asset during economic uncertainty.

Gold and Silver

Investing in gold and silver can be done through physical ownership, ETFs, or mining stocks. These metals have historically maintained their value over time, making them a popular choice for hedging.

Agricultural Commodities

Agricultural commodities, such as corn, wheat, and soybeans, offer another avenue for investment. These commodities are influenced by global demand and supply factors, including weather conditions and geopolitical events.

Collectibles and Tangible Assets

Collectibles, including art, rare coins, and other unique items, can appreciate in value over time.

“Investing in art, for example, not only provides a potential financial return but also offers the joy of owning a piece of culture and history.”

However, the value of collectibles can be subjective and illiquid, requiring a long-term perspective.

Retirement-Focused Investment Vehicles

Effective retirement planning requires a deep understanding of the investment vehicles designed to support your long-term goals. Retirement investments can be optimized through various strategies and accounts.

401(k) and IRA Optimization

Maximizing your 401(k) and IRA accounts is crucial for retirement savings. Contributions to these accounts can significantly impact your retirement corpus. It’s essential to understand the contribution limits and catch-up contributions available, especially if you’re over 50.

Roth vs. Traditional Accounts

Choosing between Roth and traditional accounts depends on your tax strategy and retirement goals. Traditional accounts offer tax-deferred growth, while Roth accounts provide tax-free withdrawals in retirement. Consider your current tax bracket and expected retirement tax bracket when deciding.

Target-Date Funds

Target-date funds offer a simplified approach to retirement investing. These funds automatically adjust their asset allocation based on your retirement date, becoming more conservative as you approach retirement. This can be an attractive option for those who prefer a hands-off investment strategy.

By understanding and leveraging these retirement-focused investment vehicles, you can create a robust retirement plan tailored to your needs.

Low-Risk Investment Options

In today’s unpredictable financial landscape, investors are turning to low-risk investment options to secure their assets. These investments are designed to provide stability and security, making them ideal for those looking to minimize their exposure to market volatility.

High-Yield Savings Accounts

One of the most accessible low-risk investments is the high-yield savings account. These accounts offer a higher interest rate compared to traditional savings accounts, allowing investors to earn more on their deposits while maintaining liquidity.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are another low-risk option that provides a fixed return for a specified term. CDs are time deposits offered by banks with a fixed interest rate and maturity date, making them a predictable investment choice.

Treasury Inflation-Protected Securities (TIPS)

Treasury Inflation-Protected Securities (TIPS) are designed to protect investors against inflation. The principal amount of TIPS adjusts with inflation rates, ensuring that the purchasing power of the investment is maintained over time.

By incorporating these low-risk investment options into their portfolios, investors can achieve a balance between risk and return, ensuring a more stable financial future.

ESG and Impact Investing

ESG and impact investing have gained substantial traction, offering investors a way to align their financial goals with their personal values. This investment approach considers environmental, social, and governance factors to promote sustainable and responsible investments.

Environmental Sustainability Funds

Environmental sustainability funds focus on companies that promote eco-friendly practices and reduce carbon footprints. These funds invest in renewable energy, green technologies, and companies with strong environmental track records.

Social Responsibility Investments

Social responsibility investments consider the social impact of companies, including their labor practices, community engagement, and product safety. Investors can support companies that prioritize social welfare and ethical business practices.

Governance-Focused Companies

Governance-focused companies prioritize ethical governance practices, including transparent leadership, board diversity, and anti-corruption measures. Investing in these companies can help promote a culture of accountability and integrity.

Here’s a comparison of different ESG investment options:

| Investment Type | Focus Area | Potential Benefits |

|---|---|---|

| Environmental Sustainability Funds | Eco-friendly practices, renewable energy | Reduced carbon footprint, potential for long-term growth |

| Social Responsibility Investments | Labor practices, community engagement | Improved social welfare, enhanced brand reputation |

| Governance-Focused Companies | Ethical governance, transparent leadership | Increased accountability, reduced risk of corruption |

By incorporating ESG and impact investing into their portfolios, investors can contribute to a more sustainable and equitable future while potentially achieving their financial objectives.

Investment Strategies by Life Stage

As individuals progress through different life stages, their investment strategies should adapt to meet changing financial goals and risk tolerance. Tailoring investments to one’s life stage is crucial for achieving financial success. This approach ensures that investment decisions align with current needs and long-term objectives.

Early Career: Building Wealth

In the early stages of one’s career, the focus should be on building wealth through aggressive yet diversified investments. This can include a mix of stocks, real estate, and other growth-oriented assets.

“Starting early gives you a significant advantage due to the power of compounding,”

notes a financial expert. Allocating a portion of income towards high-growth investments can significantly impact long-term financial health.

Mid-Career: Growth and Preservation

As individuals reach mid-career, their investment strategy should shift towards balancing growth and preservation. This involves maintaining a mix of aggressive and conservative investments to protect accumulated wealth while continuing to grow it. Strategies may include diversifying into bonds, dividend-paying stocks, and other income-generating assets.

Pre-Retirement: Income and Protection

Approaching retirement, the focus should be on generating income and protecting wealth. Investments at this stage may include annuities, dividend stocks, and other income-producing vehicles. Ensuring that investments are aligned with retirement goals is critical for financial security in the post-work life.

Building a Diversified Investment Portfolio

A well-diversified portfolio is the cornerstone of a successful investment strategy, helping to mitigate risk and maximize returns. To achieve this, investors must consider several key factors.

Asset Allocation Principles

Asset allocation involves distributing investments across various asset classes, such as stocks, bonds, and real estate. This distribution helps manage risk by ensuring that no single asset class dominates the portfolio. Effective asset allocation is tailored to the individual investor’s risk tolerance, financial goals, and investment horizon.

Rebalancing Strategies

Over time, market fluctuations can cause a portfolio’s asset allocation to drift from its target. Rebalancing involves periodically reviewing and adjusting the portfolio to maintain the desired allocation, ensuring that the investment strategy remains aligned with the investor’s objectives.

Risk Management Techniques

Risk management is crucial for protecting investments. Techniques include:

Hedging Against Market Volatility

- Strategies such as diversification and the use of derivatives can help mitigate the impact of market volatility.

Dollar-Cost Averaging

- This involves investing a fixed amount of money at regular intervals, regardless of the market’s performance, reducing the impact of volatility.

By understanding and implementing these strategies, investors can build a diversified portfolio that supports their long-term financial goals.

Conclusion: Taking Action on Investment Opportunities

Exploring top investment opportunities is a crucial step towards achieving financial growth. By understanding the various investment options available, from traditional stocks and bonds to alternative investments and ESG considerations, investors can make informed decisions.

Taking action on these investment opportunities requires a tailored approach, considering individual financial goals and risk tolerance. Creating a comprehensive investment plan is essential for long-term financial success.

Investors are encouraged to take the next step, consulting with financial advisors if needed, to start investing in opportunities that best suit their needs. By doing so, they can capitalize on the potential for financial growth and secure their financial future.

By taking action on investment opportunities, individuals can work towards achieving their financial objectives, whether it’s building wealth, generating income, or protecting assets.

FAQ

What are the top investment opportunities in 2023?

The top investment opportunities in 2023 include emerging sectors such as technology and innovation, healthcare, and biotech, as well as established markets like consumer goods and energy transition.

How do economic factors influence investment decisions?

Economic factors such as interest rates, inflation, and global events shape the financial landscape and influence investment decisions. Understanding these factors is crucial for making informed investment choices.

What are the benefits of diversifying an investment portfolio?

Diversifying an investment portfolio helps manage risk and achieve long-term financial success by distributing investments across different asset classes.

What are blue-chip stocks, and why are they a good investment option?

Blue-chip stocks are known for their reliability and stability, making them a great choice for conservative investors seeking steady returns.

How do Real Estate Investment Trusts (REITs) work?

REITs allow investors to participate in the real estate market without directly managing properties, providing a way to diversify their investment portfolio.

What are the advantages of investing in Treasury Inflation-Protected Securities (TIPS)?

TIPS protect against inflation, as their principal adjusts with inflation rates, making them a low-risk investment option.

What is ESG investing, and why is it becoming increasingly popular?

ESG (Environmental, Social, and Governance) investing allows investors to align their investments with their values, focusing on companies that promote sustainability, social responsibility, and ethical governance practices.

How should investment strategies change according to life stages?

Investment strategies should be tailored to an individual’s life stage, focusing on building wealth early in one’s career, balancing growth and preservation mid-career, and generating income and protecting wealth as retirement approaches.

What are the principles of asset allocation, and why is it important?

Asset allocation principles guide the distribution of investments across different asset classes, helping to manage risk and achieve long-term financial success.

How can investors manage risk in their investment portfolios?

Investors can manage risk through rebalancing strategies, hedging against market volatility, and dollar-cost averaging, among other risk management techniques.

What is the difference between Roth and traditional retirement accounts?

Understanding the differences between Roth and traditional accounts is essential for tax planning, as they have different tax implications and rules for withdrawals.

What are the benefits of investing in dividend stocks?

Dividend stocks provide a regular income stream, making them attractive to investors seeking predictable returns.

How do cryptocurrency and blockchain technology present investment opportunities?

Cryptocurrency and blockchain technology have gained significant attention, presenting both opportunities and risks for investors willing to take on the challenge.

Crypto Casinos – Best Bitcoin & Altcoin Gambling Platforms

The world of online gambling is experiencing a significant shift with the rise of Crypto Casinos, where players can use cryptocurrencies like Bitcoin and various altcoins to place bets. This trend is driven by the desire for anonymity, security, and the potential for higher rewards.

As Bitcoin Gambling and Altcoin Gambling Platforms continue to gain popularity, it’s essential for enthusiasts to understand the benefits and risks associated with these platforms. Our article aims to provide an overview of the top Crypto Casinos, highlighting their unique features and advantages.

Key Takeaways

- Discover the benefits of using Crypto Casinos for online gambling.

- Explore the top platforms for Bitcoin and altcoin gambling.

- Understand the security measures in place to protect your transactions.

- Learn about the variety of games available on Crypto Casinos.

- Get insights into the bonuses and promotions offered by these platforms.

Understanding Crypto Casinos: The Future of Online Gambling

The world of online gambling is undergoing a significant transformation with the advent of crypto casinos. As the popularity of cryptocurrencies like Bitcoin and Altcoins continues to grow, so does the number of online casinos that accept these digital currencies.

Definition and Basic Functionality

Crypto casinos are online gambling platforms that use cryptocurrencies as their primary method of transaction. They operate similarly to traditional online casinos but offer the added benefits of using blockchain technology and cryptocurrencies. “The use of cryptocurrency in online gambling provides a level of anonymity and security that traditional payment methods cannot match.”

These casinos typically offer a range of games, including slots, table games, and live dealer options, all accessible using cryptocurrencies. The basic functionality revolves around creating an account, depositing cryptocurrency, and playing games.

Differences Between Traditional and Crypto Casinos

One of the main differences between traditional and crypto casinos is the payment method. Crypto casinos allow for deposits and withdrawals in cryptocurrencies, which can offer lower transaction fees and faster processing times compared to traditional payment methods.

Another significant difference is the level of anonymity and privacy. Crypto casinos often do not require the same level of personal identification as traditional casinos, making them appealing to those who value their privacy. As noted by a crypto casino expert,

“The anonymity provided by crypto casinos is a game-changer for many players who want to keep their gambling activities private.”

Additionally, crypto casinos are often more accessible to players from countries with restrictions on traditional online gambling, as they operate on a decentralized model.

The Rise of Crypto Casinos in the Gambling Industry

The emergence of crypto casinos has revolutionized the online gambling landscape, offering a new paradigm for players worldwide. This shift is driven by the inherent benefits of cryptocurrency, including enhanced security, anonymity, and faster transaction times.

Historical Development

Crypto casinos began to appear around 2013-2014, coinciding with the rise of Bitcoin. The first crypto casinos were primarily focused on Bitcoin, but as the cryptocurrency market expanded, so did the range of accepted digital currencies. Key milestones include:

- The launch of the first Bitcoin-only casinos

- The introduction of altcoin support

- The development of provably fair gaming technologies

This historical context is crucial for understanding the current state of crypto casinos and their potential future in the gambling industry.

Current Market Trends

Today, the crypto casino market is characterized by rapid growth and increasing competition. Key trends include:

- Increased adoption of altcoins

- Integration of advanced technologies like blockchain and AI

- Growing demand for provably fair gaming experiences

These trends indicate a maturing market that is becoming more sophisticated and player-centric. As the gambling industry continues to evolve, crypto casinos are poised to play a significant role in shaping its future.

Benefits of Using Cryptocurrency for Online Gambling

Cryptocurrency has transformed online gambling by providing a secure, efficient, and borderless way to play. This shift has brought numerous advantages to players, making the gambling experience more enjoyable and accessible.

Enhanced Privacy and Anonymity

One of the significant benefits of using cryptocurrency for online gambling is the enhanced privacy and anonymity it offers. Transactions are recorded on a public ledger, but the identities of the parties involved are not disclosed, ensuring a higher level of confidentiality.

Lower Transaction Fees

Cryptocurrency transactions typically have lower fees compared to traditional payment methods. This reduction in transaction costs benefits both the player and the casino, allowing for more competitive gaming environments.

Faster Deposits and Withdrawals

The use of cryptocurrency enables faster deposits and withdrawals, as transactions are processed in real-time or near real-time, depending on the blockchain’s congestion. This immediacy enhances the overall gaming experience.

Borderless Transactions

Cryptocurrency facilitates borderless transactions, allowing players from around the world to participate in online gambling without the restrictions imposed by traditional currency exchange regulations. This global accessibility expands the reach of online casinos.

By leveraging cryptocurrency, online gambling platforms can offer a more secure, efficient, and inclusive environment for players worldwide. The benefits of cryptocurrency in online gambling are clear, making it an attractive option for those looking to enhance their gaming experience.

Top Crypto Casinos for Bitcoin Gambling

The rise of crypto casinos has transformed the gambling landscape, providing Bitcoin enthusiasts with a secure and entertaining way to gamble online. With numerous platforms emerging, it can be challenging to identify the best options. This section reviews the top crypto casinos for Bitcoin gambling, focusing on their unique features, advantages, and disadvantages.

BC.Game

BC.Game is a prominent player in the crypto casino scene, known for its extensive game selection and competitive bonuses.

Overview

BC.Game offers a wide range of games, including slots, table games, and live dealer options, all accessible with Bitcoin.

Pros

- Extensive Game Library: With hundreds of games, BC.Game caters to diverse player preferences.

- Competitive Bonuses: New players are welcomed with generous bonuses, enhancing their gaming experience.

- Provably Fair: BC.Game employs provably fair technology, ensuring transparency and fairness in all games.

Cons

- Complex Interface: The platform’s extensive features can make it challenging for new users to navigate.

- Limited Fiat Currency Support: BC.Game is primarily designed for cryptocurrency, which may limit its appeal to players who prefer traditional currencies.

Features

BC.Game stands out with its VIP program, offering rewards and exclusive benefits to loyal players. The platform also hosts regular tournaments, adding a competitive edge to the gaming experience.

Stake.com

Stake.com is another leading crypto casino that has gained popularity for its user-friendly interface and innovative features.

Overview

Stake.com provides a seamless gambling experience, allowing players to bet with Bitcoin and other cryptocurrencies.

Pros

- User-Friendly Interface: Stake.com is designed for ease of use, making it accessible to players of all experience levels.

- Innovative Features: The platform offers unique features such as originals and dice games, setting it apart from other casinos.

- High-Limit Bets: Stake.com accommodates high rollers with its high-limit betting options.

Cons

- Limited Game Selection: While Stake.com offers some popular games, its selection is not as extensive as some other platforms.

- Customer Support: Some users have reported mixed experiences with customer support.

Features

Stake.com is known for its original games, which provide a fresh twist on traditional casino entertainment. The platform also offers a daily racing feature, allowing players to participate in virtual races.

BitStarz

BitStarz is a well-established crypto casino that has built a reputation for its reliability and diverse gaming options.

Overview

BitStarz offers a comprehensive gambling experience, with a wide range of games and attractive bonuses.

Pros

- Diverse Gaming Options: BitStarz features a broad selection of slots, table games, and live dealer games.

- Licensed and Regulated: The casino is licensed, ensuring a secure and fair gaming environment.

- Generous Bonuses: BitStarz offers competitive bonuses to both new and existing players.

Cons

- Withdrawal Limits: Some players have noted that withdrawal limits can be restrictive.

- Complex KYC Process: The casino’s Know Your Customer (KYC) process can be lengthy.

Features

BitStarz is recognized for its progressive jackpots, offering players the chance to win significant sums. The platform also features a VIP program, rewarding loyal players.

Cloudbet

Cloudbet is a popular crypto casino that offers a unique blend of sports betting and casino games.

Overview

Cloudbet provides a comprehensive betting platform, allowing users to wager on sports and play casino games with Bitcoin.

Pros

- Sports Betting Options: Cloudbet offers an extensive range of sports betting markets.

- Cryptocurrency Support: The platform supports multiple cryptocurrencies, catering to diverse player preferences.

- Competitive Odds: Cloudbet is known for its competitive odds, enhancing the betting experience.

Cons

- Limited Casino Games: While Cloudbet excels in sports betting, its casino game selection is somewhat limited.

- Outdated Interface: Some users have noted that the platform’s interface could be updated.

Features

Cloudbet stands out with its live betting options, allowing players to bet on sports events as they unfold. The platform also offers a cash out feature, providing players with more control over their bets.

| Casino | Key Features | Bonuses |

|---|---|---|

| BC.Game | Extensive game library, Provably Fair | Competitive welcome bonus |

| Stake.com | User-friendly interface, Original games | Generous sign-up bonus |

| BitStarz | Diverse gaming options, Licensed and Regulated | Attractive bonuses for new and existing players |

| Cloudbet | Sports betting options, Competitive odds | Competitive sports betting bonuses |

Best Altcoin Gambling Platforms

Altcoin gambling has gained significant traction, offering diverse options for players looking beyond traditional Bitcoin casinos. As the cryptocurrency landscape continues to evolve, these platforms provide a fresh alternative for online gamblers, catering to a wide range of digital assets.

Rollbit (Ethereum-based)

Rollbit is a prominent Ethereum-based gambling platform that has gained popularity among altcoin enthusiasts. It offers a wide range of games and betting options, leveraging the Ethereum blockchain for transparency and fairness.

Overview

Rollbit provides a comprehensive gambling experience, with a focus on Ethereum-based transactions. The platform is known for its user-friendly interface and diverse gaming options.

Pros

- High liquidity: Rollbit offers high liquidity, ensuring that players can easily deposit and withdraw their Ethereum.

- Diverse gaming options: The platform features a wide range of games, including slots, dice, and sports betting.

Cons

- Limited support for other cryptocurrencies: As an Ethereum-based platform, Rollbit is limited in its support for other digital assets.

- Complex for beginners: The platform’s focus on Ethereum and advanced features may be daunting for new users.

Features

Rollbit boasts several key features, including a user-friendly interface, provably fair gaming, and regular tournaments. The platform also offers a loyalty program, rewarding users for their continued participation.

FortuneJack (Litecoin and Dogecoin)

FortuneJack is a well-established crypto casino that supports a variety of altcoins, including Litecoin and Dogecoin. It offers a robust gambling experience, with a wide range of games and betting options.

Overview

FortuneJack is known for its versatility, supporting multiple cryptocurrencies and offering a comprehensive gambling experience. The platform is designed to be accessible to both new and experienced players.

Pros

- Multi-cryptocurrency support: FortuneJack supports a range of digital assets, including Litecoin and Dogecoin.

- Provably fair gaming: The platform utilizes provably fair technology to ensure transparency and fairness in its games.

Cons

- Outdated interface: Some users may find the platform’s interface to be outdated compared to newer casinos.

- Limited live dealer options: FortuneJack’s live dealer selection is somewhat limited compared to other platforms.

Features

FortuneJack features a diverse game selection, including slots, table games, and live dealer options. The platform also offers regular promotions and a loyalty program to reward its users.

mBit Casino (Multi-Cryptocurrency)

mBit Casino is a multi-cryptocurrency gambling platform that supports a wide range of digital assets. It offers a comprehensive gambling experience, with a focus on fairness and transparency.

Overview

mBit Casino is designed to be accessible to users of various cryptocurrencies, offering a broad range of games and betting options.

Pros

- Broad cryptocurrency support: mBit Casino supports a wide range of digital assets, making it accessible to a broad user base.

- Provably fair gaming: The platform is committed to fairness, utilizing provably fair technology in its games.

Cons

- Complex navigation: The platform’s extensive features and options may be overwhelming for some users.

- Limited information on licensing: Some users may be concerned about the lack of detailed information on the platform’s licensing and regulation.

Features

mBit Casino boasts a comprehensive game selection, including slots, table games, and live dealer options. The platform also features regular tournaments and a VIP program for its loyal users.

TrueFlip (Altcoin Specialist)

TrueFlip is a crypto casino that specializes in altcoin gambling, supporting a variety of digital assets. It is known for its fairness and transparency, utilizing blockchain technology to ensure a secure gambling experience.

Overview

TrueFlip is designed to cater to altcoin enthusiasts, offering a range of games and betting options across multiple cryptocurrencies.

Pros

- Multi-altcoin support: TrueFlip supports a variety of altcoins, making it a versatile option for users.

- Blockchain-based fairness: The platform leverages blockchain technology to ensure provably fair gaming.

Cons

- Limited Bitcoin support: TrueFlip is more focused on altcoins, which may be a drawback for Bitcoin enthusiasts.

- Complex user interface: Some users may find the platform’s interface to be complex and difficult to navigate.

Features

TrueFlip features a diverse game selection, including slots and table games. The platform also offers regular promotions and a loyalty program to reward its users.

Popular Games Available at Crypto Casinos

From classic slots to sophisticated table games, crypto casinos have something for every kind of player. The variety of games available is one of the main attractions of crypto casinos, offering an exciting experience for both new and seasoned players.

Slots and Jackpots

Slots are a staple in the world of crypto casinos, offering a range of themes and jackpot sizes. Progressive jackpots can lead to life-changing wins, making them a popular choice among players. With engaging graphics and varied betting options, slots provide endless entertainment.

Table Games

Table games such as Bitcoin Blackjack, Roulette, and Baccarat are also widely available. These games offer a more traditional casino experience, with the added benefit of using cryptocurrencies for transactions. The rules and gameplay are similar to their traditional counterparts, but with the added security and anonymity of blockchain technology.

Live Dealer Options

For those seeking a more immersive experience, live dealer options are available at many crypto casinos. This feature allows players to interact with real dealers via live stream, creating a more authentic casino atmosphere from the comfort of their own homes.

Crypto-Exclusive Games

Some crypto casinos also offer games that are exclusive to cryptocurrency users. These can include blockchain-based games that utilize smart contracts to ensure fairness and transparency. Such games often come with unique features that can’t be found in traditional online casinos.

Security and Fair Play in Crypto Gambling

Security and fairness are paramount in the world of crypto gambling, where transparency is key. As the industry continues to evolve, it’s essential for players to understand the measures in place to protect their assets and ensure a fair gaming experience.

Provably Fair Technology Explained

One of the significant advantages of crypto casinos is the use of provably fair technology. This innovative approach allows players to verify the fairness of each game, ensuring that the outcome is genuinely random and not manipulated by the casino. Provably fair technology uses cryptographic algorithms to secure game outcomes, providing a transparent and trustworthy gaming environment.

The process typically involves:

- A server seed generated by the casino

- A client seed provided by the player

- A nonce that changes with each game round

This combination creates a unique hash that determines the game’s outcome, allowing players to check the fairness of the result.

Licensing and Regulation

Reputable crypto casinos are licensed and regulated by recognized authorities, such as the Curacao Gaming Authority or the Malta Gaming Authority. These licenses ensure that the casinos operate within strict guidelines, maintaining fairness and security for players. Licensing involves rigorous checks on the casino’s financial stability, game fairness, and player protection policies.

Protecting Your Crypto Assets

While crypto casinos implement robust security measures, players also have a role in protecting their assets. It’s recommended to:

- Use strong, unique passwords for your accounts

- Enable two-factor authentication (2FA) whenever possible

- Keep your cryptocurrency wallet software up to date

- Be cautious of phishing attempts and never share sensitive information

By taking these precautions and choosing reputable, licensed crypto casinos, players can enjoy a secure and fair gaming experience.

Legal Considerations for US Crypto Casino Players

US players face unique legal considerations when engaging with crypto casinos. The legal landscape is influenced by both federal and state regulations, making it crucial for players to understand these laws to avoid potential legal issues.

Federal and State Regulations

The legality of online gambling, including crypto casinos, varies significantly across different states in the US. While some states have legalized online gambling, others have strict laws prohibiting it. At the federal level, laws such as the Unlawful Internet Gambling Enforcement Act (UIGEA) of 2006 play a significant role in regulating online gambling activities.

It’s essential for players to be aware of the specific laws in their state to ensure they are complying with local regulations.

Offshore Crypto Gambling Sites

Many US players turn to offshore crypto gambling sites due to their often more favorable terms and wider range of games. However, engaging with offshore sites can pose legal risks, as these platforms may not be licensed or regulated by US authorities.

“Players should be cautious and thoroughly research any offshore site before use.”

Tax Implications of Crypto Gambling Winnings

Gambling winnings in cryptocurrency are subject to taxation. The IRS treats cryptocurrency as property for tax purposes, meaning that winnings are taxable and must be reported. Players should keep accurate records of their transactions to comply with tax laws.

Conclusion

The world of online gambling has undergone a significant transformation with the advent of crypto casinos. These platforms offer a unique blend of security, privacy, and excitement, making them an attractive option for players worldwide.

As discussed, crypto casinos provide numerous benefits, including enhanced privacy and anonymity, lower transaction fees, and faster deposits and withdrawals. The use of cryptocurrencies like Bitcoin and altcoins has opened up new opportunities for players to enjoy their favorite games without the constraints of traditional payment methods.

With a range of top crypto casinos available, including BC.Game, Stake.com, and BitStarz, players can choose from a variety of games, including slots, table games, and live dealer options. As the crypto gambling industry continues to evolve, it’s clear that crypto casinos are here to stay.

Whether you’re a seasoned player or just starting out, exploring the world of crypto casinos can be a rewarding experience. By understanding the benefits and opportunities available, you can make informed decisions and enjoy the exciting world of online gambling.

FAQ

What is a crypto casino?

A crypto casino is an online gambling platform that accepts cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, as a form of payment for gaming activities.

How do crypto casinos differ from traditional online casinos?

Crypto casinos differ from traditional online casinos in that they use blockchain technology and cryptocurrencies, offering benefits like enhanced privacy, lower transaction fees, and faster deposits and withdrawals.

Are crypto casinos safe to use?

Crypto casinos can be safe to use if they employ provably fair technology, are properly licensed, and have a good reputation. Players should also take steps to protect their crypto assets.

Can I play games at a crypto casino using my credit card?

Most crypto casinos are designed for cryptocurrency transactions, but some may allow traditional payment methods. However, the primary benefit of using a crypto casino is the ability to gamble with cryptocurrencies.

What are the benefits of using cryptocurrency for online gambling?

The benefits include enhanced privacy and anonymity, lower transaction fees, faster deposits and withdrawals, and the ability to make borderless transactions.

How do I choose a reputable crypto casino?

To choose a reputable crypto casino, look for platforms that are licensed, have a good reputation, use provably fair technology, and offer a wide range of games and cryptocurrencies.

Can I gamble with altcoins at crypto casinos?

Yes, many crypto casinos support altcoins, such as Ethereum, Litecoin, and Dogecoin, in addition to Bitcoin, allowing players to diversify their gambling activities.

What types of games are available at crypto casinos?

Crypto casinos offer a variety of games, including slots, table games like Bitcoin Blackjack and Roulette, live dealer options, and exclusive crypto games.

Are crypto casino winnings taxable?

Yes, crypto casino winnings are subject to tax implications, and players should be aware of their tax obligations when gambling with cryptocurrencies.

How do I protect my crypto assets while gambling online?

To protect your crypto assets, use secure wallets, enable two-factor authentication, and be cautious when sharing personal and financial information online.

Nasen-op.net – Your Trusted Source for Rhinoplasty Information & Surgeon Reviews

Welcome to Nasen-op.net, your go-to online resource for comprehensive and reliable rhinoplasty information. Our mission is to empower individuals considering nose surgery by providing essential insights into the various aspects of the procedure. Whether you’re interested in surgical techniques, recovery timelines, or the crucial step of selecting a qualified surgeon, we have you covered with our extensive nose surgery guide. At Nasen-op.net, you will find valuable resources, expert insights, and authentic surgeon reviews that will help you make well-informed decisions on your rhinoplasty journey.

Navigating through our platform will enlighten you on key considerations that contribute to a positive surgical experience, ensuring that you are well-prepared for what lies ahead. With Nasen-op.net, you are not just a visitor; you are part of a community that prioritizes informed choices in the realm of rhinoplasty.

Key Takeaways

- Nasen-op.net offers extensive rhinoplasty information to support your decision-making process.

- Genuine surgeon reviews help you find experienced professionals.

- Understanding surgical techniques is crucial for preparing for your procedure.

- Recovery information provides insights into what to expect post-surgery.

- The importance of choosing the right surgeon cannot be overstated.

- Empower yourself with knowledge to enhance your overall surgical experience.

- Your journey begins with informed choices and trusted resources.

Understanding Rhinoplasty: What You Need to Know

Rhinoplasty is a surgical procedure aimed at altering the shape of the nose for both cosmetic and functional reasons. Many individuals seek rhinoplasty to enhance their facial symmetry or to address breathing issues. Understanding the Rhinoplasty basics helps patients consider the multiple aspects involved in the surgery.

When looking into nose surgery information, it is important to know there are two primary techniques: open and closed rhinoplasty. Open rhinoplasty involves an external incision, allowing for more extensive reshaping, while closed rhinoplasty uses incisions inside the nostrils. Your choice may depend on personal preference and the complexity of changes being made.

Many benefits accompany rhinoplasty, such as improved facial harmony and potentially better airflow through the nasal passages. Still, it is imperative to acknowledge that risks exist. Complications can arise, including infection, bleeding, or dissatisfaction with the final outcome.

Setting realistic expectations is crucial when considering what is rhinoplasty. Results vary significantly based on your individual anatomy and personal goals. By comprehending these foundational elements, individuals can make more informed decisions and prepare thoughtfully for their rhinoplasty journey.

The Importance of Choosing the Right Surgeon

Selecting the right surgeon plays a vital role in achieving the desired results from rhinoplasty. Proper evaluation of a candidate’s qualifications is essential, as it directly impacts both the aesthetic and functional outcomes of the procedure. When choosing a surgeon, individuals should focus on their rhinoplasty surgeon credentials and the level of training they have undergone in this specialized field.

Experience matters greatly in surgical practice. A surgeon with extensive surgeon experience specific to rhinoplasty can provide a more refined understanding of the complexities involved, ensuring that each surgery is tailored to the patient’s unique facial structure. Confirming credentials such as board certification and membership in professional organizations can offer reassurance regarding a surgeon’s competency.

It is equally important to analyze before-and-after pictures of previous patients. Such visual confirmations can give prospective patients an accurate sense of the surgeon’s style and success rates. Recommendations from friends, family, or healthcare professionals may also guide the selection process, fostering a sense of trust and confidence in the chosen surgeon.

Ultimately, making an informed decision regarding choosing a surgeon can reduce the risks associated with rhinoplasty and enhance the likelihood of achieving satisfying results. Investing time in research and comparison will pay off in the long run.

Nasen-op.net: Comprehensive Guides and Resources

Nasen-op.net serves as an invaluable platform offering a range of Rhinoplasty resources that support patients throughout their surgery journey. Understanding what to expect can streamline the process, making it less daunting for individuals considering rhinoplasty.

What to Expect from Your Rhinoplasty Journey

The surgery journey begins with initial consultations where patients discuss their goals and concerns with the surgeon. Pre-operative assessments are crucial to ensure that candidates meet the necessary health requirements. On the surgical day, patients receive comprehensive care from the medical team, guiding them through every step of the procedure. Follow-up visits play a significant role in recovery, allowing both the surgeon and patient to monitor progress and address any concerns.

Types of Rhinoplasty Procedures Explained

Each individual’s needs may differ, leading to various types of rhinoplasty. The primary rhinoplasty aims to reshape the nose for aesthetic improvement, while revision rhinoplasty addresses concerns from previous surgeries. Ethnic rhinoplasty respects diverse facial features, tailoring the procedure to meet specific cultural attributes. By understanding these distinct types of rhinoplasty, patients can make more informed decisions about their choices.

User Reviews: Real Experiences from Rhinoplasty Patients

User reviews play a crucial role in the rhinoplasty decision-making process. Prospective patients benefit significantly from reading real testimonials that detail patient experiences with various surgeons. These insights help individuals understand not only the surgical procedure itself but also the results they can expect after recovery. Rhinoplasty patient reviews often highlight positive and negative aspects, allowing for a well-rounded evaluation of options.

How to Interpret Reviews Effectively

Interpreting surgeon reviews requires careful consideration. It is important to differentiate between constructive feedback and individual opinions that may not reflect the overall quality of care. When analyzing rhinoplasty patient reviews, pay attention to common themes, as these can indicate trends in surgical outcomes and patient satisfaction. Look for consistent remarks regarding the surgeon’s skill, the clarity of communication, and the level of post-operative care provided. This approach can help filter out subjective sentiments and provide a more objective view of a surgeon’s capabilities.

Factors to Consider When Selecting a Rhinoplasty Surgeon

Choosing the right professional is pivotal when undergoing rhinoplasty. When selecting a surgeon, assess their experience specifically in rhinoplasty procedures. Surgeons with a robust portfolio in this area can navigate complex cases more effectively, demonstrating their expertise and success in achieving desired results.

Another crucial factor involves understanding the surgeon’s approach to aesthetic concerns. Each individual’s facial structure and goals are different. A surgeon who takes the time to listen and adapt the procedure to meet your unique needs will greatly enhance the likelihood of a satisfactory outcome.

Effective communication is a key element to consider. Surgeons who foster an environment of open dialogue can put their patients at ease, providing clarity on all aspects of the surgical process. Patient comfort and trust in their surgeon should not be underestimated, as this relationship influences the overall experience and recovery journey.

Consulting multiple surgeons before making a final decision offers numerous benefits. This practice allows individuals to evaluate various surgeon evaluations and perspectives. It will enable a deeper understanding of the surgical options and best practices available. Patients can compare rhinoplasty factors, ensuring they find a surgeon whose philosophy aligns with their expectations and needs.

| Factor | Description |

|---|---|

| Experience | A surgeon’s years of performing rhinoplasty procedures and their success rates. |

| Aesthetic Approach | How the surgeon customizes techniques based on individual patient needs. |

| Communication Style | The effectiveness of the surgeon in conveying information and listening to patients. |

| Patient Comfort | The level of trust and comfort the patient feels with the surgeon. |

Being informed about these essential factors will assist in making a well-rounded decision when selecting a surgeon for rhinoplasty.

The Cost of Rhinoplasty: What Influences Pricing

Understanding the various factors affecting rhinoplasty cost is essential for anyone considering this procedure. Various influencing factors contribute to the overall expense associated with surgery, including the surgeon’s experience, geographic location, facility fees, and anesthesia costs. Being aware of these elements enables patients to budget effectively and avoid unexpected financial burdens.

Comparing Costs: What’s Included?

Breaking down the costs of rhinoplasty provides a clearer picture of what to expect financially. Below is a comprehensive surgery pricing breakdown to assist potential patients in understanding the expenses associated with the procedure:

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Surgeon’s Fee | Fee charged by the surgeon for the procedure, which varies based on expertise. | $5,000 – $10,000 |

| Facility Fees | Costs for using the surgery center or hospital facilities. | $1,000 – $3,000 |

| Anesthesia Fees | Charges for the anesthesia required during the surgery. | $600 – $1,200 |

| Pre-operative Consultations | Costs related to initial visits and assessments before surgery. | $100 – $500 |

| Post-operative Follow-ups | Visits for evaluating recovery and managing any complications. | $200 – $400 |

By being informed about these key financial elements, patients can better prepare for the rhinoplasty cost, ensuring a smoother experience throughout the surgical journey.

Finding Rhinoplasty Surgeons Near You

Locating qualified local rhinoplasty surgeons can be a crucial step in your journey toward achieving the desired aesthetic. Utilizing resources such as Nasen-op.net can simplify the process of finding surgeons in your vicinity. Not only does this platform allow you to browse through a list of experienced professionals, but you can also read detailed reviews from past patients to gauge the quality of care provided.

Start your search by entering terms like *rhinoplasty near me* in your preferred search engine. This will lead you to various online platforms dedicated to matching patients with reputable surgeons. Medical directories and local healthcare websites often feature filters that let you specify your location, ensuring you only see results relevant to your area.

Consider engaging with social media platforms as well. Many surgeons use these channels to showcase their work and interact with potential patients. Following local rhinoplasty surgeons can give you insights into their techniques and outcomes, further aiding your decision-making process.

Utilizing these resources effectively will enable you to narrow down your options and connect with qualified professionals who have expertise in rhinoplasty. By focusing on proximity and credible endorsements, you can make informed choices about your surgery.

Nasen-op.net: Reviews of Top-Rated Surgeons

Finding the right surgeon is essential when considering rhinoplasty. Reviews on Nasen-op.net can provide valuable insights into the experiences of other patients. These reviews highlight the skills and expertise of top-rated surgeons, making it easier for potential patients to make informed decisions.

Why Reviews Matter in Your Decision-Making